Crisis, Contingency and Continuity

As educational leaders, you have been tasked with the management of your institution’s finances in these unprecedented times! A crisis brings uncertainty and change, which can lead to anxiety and stress. For effective leadership and management in the post-Covid era, this piece presents and discusses the anxiety inherent in managing an institution’s finances during and after a crisis and offers practical skills for navigating the post-Covid phenomena.

Managing your institution’s finances during and after a crisis can create a number of questions and challenges.

- Do you totally overhaul your existing budget?

- Do you drastically change allocations for line items in the budget? If you do, will you get the buy-in from staff and other stakeholders?

- Should you first meet with stakeholders to share your ideas/approach and solicit feedback, or do you present your ideas and the implementation all in one go?

- What are your colleagues’ personal concerns and challenges that have arisen due to COVID-19 and how might those impact their work performance and implementation of any new measures?

Some of these questions may have already crossed your mind. We will address the issues relating to these questions and the path forward to thriving and managing well in the ‘new normal’. This piece will empower you to navigate this important and challenging feature of the current educational landscape.

An organisation’s disaster and crisis preparedness and recovery should be an important component of its strategic plan. These are sometimes called a Business Continuity Plan or Crisis Management Plan. Such plans are critical, as Jamaica and other Caribbean countries continue to suffer from frequent natural disasters (Serrant, 2014). These include hurricanes, earthquakes, random weather patterns, epidemics and pandemics like Zika, chikungunya, dengue and COVID-19. These can seriously threaten safety, productivity and financial stability, cripple organizations and create sustainability issues if there is no plan. The robust management of the educational institution’s finances is key to its success and sustainability. For example, in the COVID era educational institutions were suddenly encumbered with increases in at least two of the line items in their budgets -health and safety and technology. The emphases, and attendant expenses, were to ensure organisation-wide continuity by securing the health and safety of stakeholders in the physical space, and providing adequate, efficient delivery of classes and other services in the virtual space. Going forward, educational leadership must plan for similar and other eventualities (Gleaner, Oct 3, 2020). The budgeted and actual expenditure in prior year(s) can guide future budget planning to satisfy continuity and crisis management expectations.

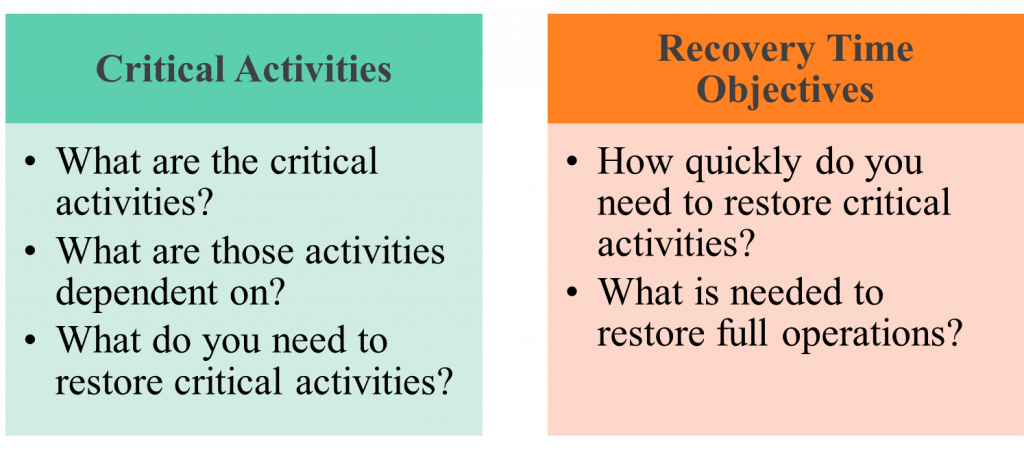

The plan must be data-driven, utilising trends that focus on needs assessment, development of risk mitigation initiatives, an organisation-wide implementation strategy, and formulation of success measurement, evaluation and feedback. In accordance with best practices, and to ensure buy-in from employees this should be a collaborative effort, utilising the expertise, discussions, review, data collection and input of all stakeholder groups including staff, suppliers, utilities providers, the assigned Education Officer, and peer institutions. According to ACCA webinar (2020), department heads and supervisors should be engaged as part of a crisis management team to conduct a Business Impact Analysis.

Financial Planning for Recovery and Organisational Viability

It is imperative that leaders collaborate and meet with their teams in an effort to conduct a needs assessment that would result in no single dominant view nor uninformed assumptions for the plan and the budget. Additionally, these would take account of any perceived challenges with the institution’s physical, financial and human resources. A team with strong control (senior management team) is required to analyse the arguments presented and make the necessary decisions. All departments and teams are important (within schools) even though the budgetary allocation, sign off and implementation are at the executive level (Goldman and Salem, 2015). The final plan, once developed, should be communicated to all staff, so everybody knows. Ultimately, the plan should result in continued organisational success, with minimum disruption to operations in the event of a disaster or crisis.

What are some possible financial threats, risks or crises to plan for, going forward?

- Adequate funding for capital expenditure on disaster mitigation and recovery costs is a serious threat to the delivery of quality service to stakeholders, maintaining sustainability, and advancing competitiveness. The educational leadership may need to find innovative ways to ‘save for a rainy day’. This may include collaboration with the community, parents and alumni to host fundraisers for a disaster/crisis fund, or initiate other income generating streams within the institution to contribute to such a fund.

2. Reputational damage can occur internally and externally as persons want to blame management and state how badly the leadership is doing. If financial matters are handled badly, this will erode staff trust (ACCA Webinar, 2020).

3. Cyber threats and attacks are prevalent and not always publicised. They tend to be instant with massive repercussions. This heightens the risk as education is now highly dependent on ICT. Technological upgrades in software and hardware can increase operational safety, efficiency and effectiveness, as well as the institution’s competitiveness in the education industry (Barr & McClellan, 2018).

4. Operational disruptions which include supply chain distribution disruption, utility supply interruption and critical infrastructure failure may also occur from adverse weather/natural disasters e.g. hurricane/earthquake (ACCA Webinar, 2020). Additional funding and critical finance management is required to get through such crises.

5. Staff Demotivation and Retention – Despite their dedication, employees may be pushed to the limit in their inability to cope with poor, prolonged recovery times; worry about jobs, friends and family; unplanned inconveniences, uncertainties and hardships; and lack of communication. These can significantly impact staff attendance and productivity, the quality of stakeholders’ experiences (especially students), institutional financial health, success and sustainability. Educational leaders must give consideration to the impact of health and social issues on staff performance in the times of crises. Financial strategies and policies going forward should promote a culture of psychological safety. Anxious stakeholders need information to reduce anxiety and fear. Effective communication of the ‘how’ and ‘why’ will encourage positive feedback to ideas. Additionally, the implementation of a Business Continuity or Crisis Management Plan will provide greater attention to staff wellbeing, inclusion in decision-making and buy-in for the activities and measures developed (ACCA Webinar, 2020). Having a voice in the decision-making process creates validation and staff respect.

There is no single template to use for all institutions. Planning and responses are dependent on the severity and duration of the impact. It is important not to lose the knowledge and momentum that the pandemic has brought, so educational leaders should do the post-incident reviews now when you can learn, adapt and create financial plans for the future. Don’t wait until it is over!

Although every institution is different, an agile response to the pandemic or anything else that will come along, disaster preparedness, recovery and mitigation, business continuity and crisis management have placed the successful development of financial management measures at the forefront for educational leadership and their stakeholders.

References

ACCA Webinar. (2020). CPD skills webinar: Business continuity in a post-pandemic world. https://www.youtube.com/watch?v=6SVoez–zq4

Peter Brady and David Hutchinson. https://www.acca-business.org/pls/ecommerce/cpd_evidence_recording.p_evidence_record?p_zz=515UOFT

Barr, M.J. & McClellan, G. S. (2018). Budgets and Financial Management in Higher Education. (3rd ed.). San Francisco, CA: Jossey-Bass. p. 31-49

Goldman, C. & Salem, H. (2015). Getting the Most Out of University Strategic Planning Essential Guidance for Success and Obstacles to Avoid. RAND Corporation. http://www.rand.org/content/dam/rand/pubs/perspectives/PE100/PE157/RAND_PE157.pdf

Jamaica Gleaner (October 3, 2020) Sustaining online education during COVID-19 and beyond https://jamaica-gleaner.com/article/commentary/20201003/caren-waugh-sustaining-online-education-during-covid-19-and-beyond

Serrant, T. (2014). Children, Learning and Chronic Natural Disasters: How does the Government of Dominica address Education During Low-intensity Hurricanes? (Doctoral dissertation, University of Pittsburgh).

Profile of the Author